Founded in 2022 by Brett Simba and based in Florida, Tradeify is quickly making waves in the proprietary trading world . With boldfeatures like “Straight to Sim Funded” accounts, high funding limits (up to $750K), and advanced journaling tools, Tradeify is positioning itself as a serious contender for futures traders—especially scalpers and risk-savvy traders.

Account & Pricing Breakdown

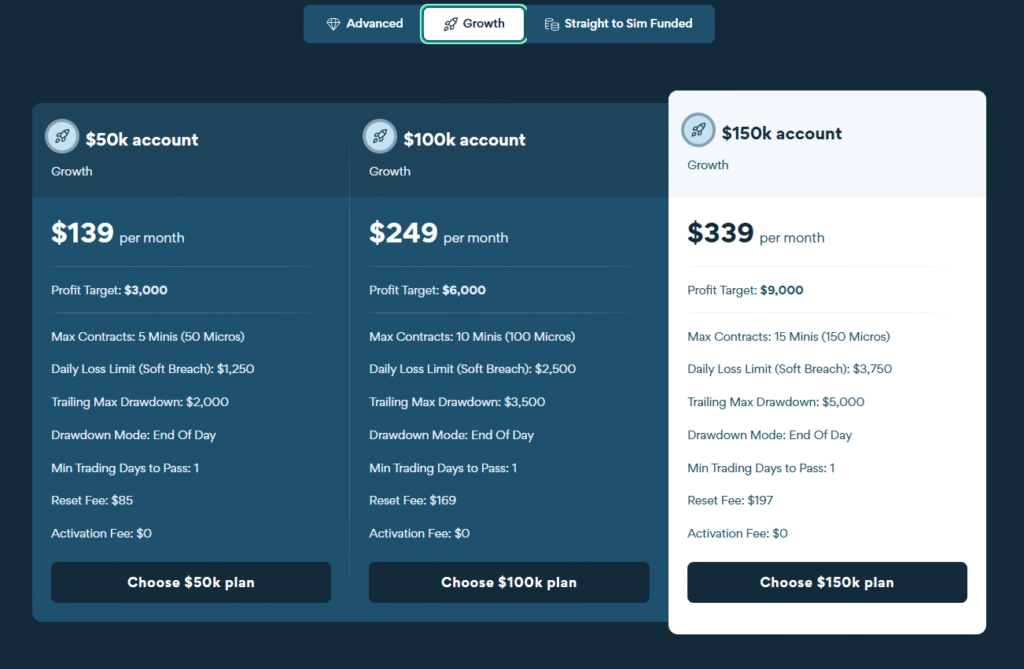

Tradeify offers three flagship options:

| Account Type | Account Size | Fee | Drawdown Type |

|---|---|---|---|

| Growth Challenge | $50K–$150K | ~$99–$229/mo | End-of-day |

| Advanced Challenge | $50K–$150K | ~$99 + fee | Intraday trailing |

| Straight to Sim Fund | $50K–$150K | ~$330–$700 | End-of-day + consistency |

You can also run up to 5–7 funded accounts simultaneously.

Profit Split & Payout Policy

First $15K profits = 100% to trader, then 90/10 split .

Payouts processed twice monthly, cleared within 24 hours after approval.

Tradeify also offers a path to live funded accounts after multiple successful payouts.

🌐 Platforms & Innovative Tools

Tradeify integrates smoothly with Tradovate, NinjaTrader, and TradingView. Its standout feature? A built-in journaling dashboard that provides real-time analytics: PNL, trade streaks, win-rate—designed to help you trade smarter .

What Traders Love (Trustpilot & Reddit)

Customer service consistently ranks #1:

“Best prop firm i’ve ever used… Super fast response time… actually helps clients”

“Tradeify has unveiled straight‑to‑funded… a godsend.”

Fast, reliable payouts:

“Once your payout… funds are immediately withdrawn”

Instant funding offers and generous drawdown allowed many scalers to join quickly.

Potential Drawbacks & Concerns

Some traders note tight drawdowns and high profit targets in Straight-to-Sim plans—threatening value for aggressive traders Critics pint to complex payout thresholds and reduced margins in certain account tiers.

As a younger firm, it lacks the decades-long reputation of Topstep, but its 4.6–4.8/5 Trustpilot ratings seem to defy that.

Tradeify vs. Other Prop Firms

Tradeify vs. Topstep

Capital Size: Tradeify goes up to $750K; Topstep maxes at $150K.

Rules: Tradeify offers both EOD and intraday drawdowns, plus consistency rules. Topstep requires 5 trading-day minimums and rigid combine criteria.

Support & Trust: Topstep has longstanding credibility and robust education; Tradeify is newer but earns praise for fast support.

Tradeify vs. Apex Trader Funding

Payouts: Both offer high profit splits, but Tradeify caps first withdrawals at $15K (vs. Apex’s $25K).

Intraday vs EOD Drawdown: Apex uses equity-based trailing drawdown; Tradeify gives more EOD flexibility.

Reputation Issues: Apex has had recent payout complaints.

Tradeify is largely undamaged.

Tradeify vs. My Funded Futures (MFF)

Pricing: MFF competitive ($80–$220) vs. Tradeify’s higher fees.

Drawdown Style: Both offer EOD drawdown; MFF is simpler. Tradeify offers more tiers & instant funding .

Payout speed: MFF also praised for fast withdrawals; Tradeify matches this .

Who Should Choose Tradeify?

Best For:

Traders craving large capital access (up to $750K).

Speed-focused scalpers/intraday traders benefited by EOD drawdowns.

People who value built-in journaling and actionable analytics.

Those wanting quick payouts processed multiple times a month.

Considerations:

Higher monthly fees may deter budget traders.

Instant funding plans might be too edgy for some—beware tight drawdowns & payout tiers.

If you need structured coaching and decades-long legacy, Topstep may still win.

⭐ Final Take

Tradeify brings a fresh, tech-savvy edge to prop trading. It offers high capital ceilings, crisp dashboard tools, strong customer support, and the allure of no-combine instant access. It’s a great match for savvy, experienced hurtlers—especially those who can handle EOD rules and want more accountability in trade journaling.

Still, traditionalists may lean toward Topstep (for mentorship and brand trust), while budget-conscious traders might prefer My Funded Futures for simplicity. Apex, though fast, has been hit by credibility concerns recently.

FAQs

What is the maximum payout for Tradeify?

The maximum payout varies based on your account size and the number of approved payout requests. After your sixth approved payout, you can request any amount up to $25,000 per account for each subsequent withdrawal.

What is the 20% rule on Tradeify?

How does the consistency rule work? No single trading day’s profit can be more than 35% (or 20% for Straight to Sim Funded accounts) of the total profits earned from the very first day of trading in the simulated funded account up to the date you request a payout.

Where is Tradeify located?

Tradeify’s headquarters are located in Miami, Florida, United States.

🚀If you’re ready to scale, track meticulously, and value speed—the Tradeify ride could be your next big launchpad. Just read the fine print.