The Best Futures Prop Firms

Why Futures Prop Trading Firms Are Gaining Popularity

A few years ago, most traders were unfamiliar with proprietary trading. Today, it has become a popular and powerful alternative to traditional retail brokerage accounts—especially in the futures market.

Futures prop firms allow traders to access large amounts of capital and trade highly liquid markets like indices, commodities, and currencies—all without risking their own funds. As this funding model gains traction, traders are increasingly seeking The Best Prop Trading Firms To Use In 2025 to take advantage of greater flexibility and scaling potential.

Over the past few years, I’ve reviewed dozens of proprietary trading firms, with a specific focus on those offering futures trading evaluations. In this article, I’ll break down The Best Prop Trading Firms To Use In 2025, analyzing their rules, funding structures, profit splits, platform access, and overall trader experience.

To help you confidently choose The Best Prop Trading Firms To Use In 2025, my rankings are based on:

-

Personal testing and user experience

-

Community feedback (both positive and negative)

-

Transparency, pricing, and long-term reliability

Top Futures Prop Firms in 2025

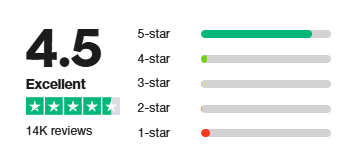

1. Apex Trader Funding

Account sizes: Up to $300,000

Profit split: Up to 90%

Discount: Use code

4r324rfor 80% off lifetime

Why It Stands Out: Apex is a favorite in the futures trading community for its flexible evaluation options, competitive pricing, and large account sizes. They offer generous profit splits and frequent promotions.

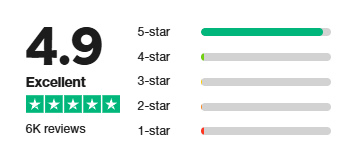

2. MyFundedFutures

Account sizes: Up to $150,000

Profit split: Varies

Discount: Check their site for current promos

Why It Stands Out: MyFundedFutures is known for transparent rules and rapid funding. A solid choice for traders who prefer clean terms and fast payouts.

👉 Get Funded with MyFundedFutures »

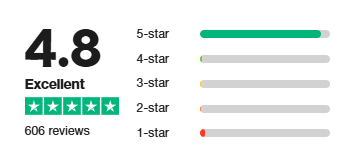

3. Take Profit Trader

Account sizes: Up to $150,000

Profit split: Competitive

Discount: Use code

efwewffor 30% off lifetime

Why It Stands Out: Offers straightforward rules and great educational resources. Ideal for newer futures traders or those looking to scale quickly.

👉 Get Funded with Take Profit Trader »

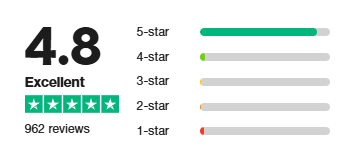

4. Tradeify

Account sizes: Up to $150,000

Profit split: Competitive

Discount: Often runs seasonal promos

Why It Stands Out: Tradeify is gaining traction for its fast evaluation phase and clear scaling plans. A good fit for traders who want more control over risk.

5. Bulenox

Account sizes: Up to $250,000

Profit split: Up to 90%

Discount: Use code for 45% off

Why It Stands Out: Bulenox blends affordability with flexibility. They allow weekend holds and scalping, which is rare in the prop space.

What Makes These the Best Prop Firms for Futures?

The futures market is one of the most actively traded and liquid financial markets globally. Top prop firms stand out by offering fair rules, fast funding, and real scaling potential.

Key Advantages of the Futures Market:

High transparency with publicly visible order books

Extended trading hours (nearly 24/5 access)

Low transaction costs and deep liquidity

High leverage and margin efficiency

Volatility and volume = consistent opportunities

Ease of short selling compared to stock markets

Challenges of Futures Trading

While futures are powerful, they require skill and discipline. Common hurdles include:

Steep learning curve for order flow and market structure

Time-intensive strategy development

Capital requirements that can be prohibitive for individuals

This is where prop firms offer real value: they remove the capital barrier and allow traders to grow within a structured, low-risk environment.

Why Trade Futures With a Prop Firm?

| Benefit | Description |

|---|---|

| Access to large capital | Trade accounts up to $300K+ |

| High profit splits | Keep up to 90% of your profits |

| No personal risk | Trade with firm capital |

| Scalable growth | Many firms offer scaling plans |

| Professional resources | Advanced platforms, mentorship, support |

Final Thoughts

If you’re serious about trading futures professionally—whether you’re day trading the E-mini S&P 500 or managing swing trades in commodities—prop firms can give you the capital, structure, and support you need to succeed.

Each firm above has been selected for its reputation, fairness, and trader-friendly environment. Choose the one that fits your strategy and risk appetite best—and always read the fine print.

💡 Pro Tip: Start with a small evaluation account and scale once you’ve proven your consistency.

Ready to Get Funded?

Explore these trusted futures prop firms, apply the discount codes, and start trading with real capital behind you. Need help choosing the right one? Drop a comment or contact us—we’ll guide you.

FAQs

Why are futures prop trading firms gaining popularity?

Several reasons:

Low capital requirement: Traders can start with minimal upfront capital.

High leverage: Access to more capital than typical retail accounts.

Remote flexibility: Many firms allow remote trading.

Profit-sharing models: Attractive profit splits (often 80–90% to the trader).

Low barrier to entry: Evaluation challenges instead of formal credentials.

Professional trading environment: Structured risk management and education.

How do evaluation accounts work?

Most firms require traders to pass an evaluation phase to prove consistency and discipline. You’ll need to:

Trade a simulated account

Meet profit targets

Follow drawdown and daily loss rules

Once passed, you receive a funded (or funded-sim) account.

What markets do futures prop firms allow you to trade?

Most firms support major futures markets, including:

E-mini and Micro E-mini S&P 500 (ES / MES)

Crude Oil (CL)

Gold (GC)

Nasdaq (NQ / MNQ)

Treasury futures (ZN, ZB, etc.)

Are payouts real, or is this just simulated trading?

Once funded, many firms offer real profit withdrawals based on performance, though some firms use "simulated" funding with payouts based on simulated results. Always read the fine print and check reviews.