Best Forex Prop Firms

Trusted Firms for Professional Traders

Forex prop firms have become vital players in today’s trading landscape, providing skilled traders with access to substantial capital and a professional trading environment. As alternative funding solutions continue to rise in popularity, more traders are turning to these firms to overcome traditional brokerage limitations and scale their strategies with institutional-grade support.

On this page, we highlight the best forex prop firms of 2025 — a handpicked selection of companies known for their transparency, funding programs, payout reliability, and overall trustworthiness. Whether you’re exploring your first funding opportunity or seeking a firm that aligns with your trading style, this guide will equip you with the insights needed to make a confident and strategic decision.

These firms do more than just provide capital — they act as long-term partners for disciplined, growth-focused traders. In a competitive and fast-paced market, aligning with a reputable prop firm gives you a distinct advantage. Take the time to evaluate your options and choose the right firm to elevate your trading career in 2025 and beyond.

How We Selected the Best Prop Trading Firms

To compile this list of top proprietary trading firms, we conducted an in-depth analysis of publicly available information. Our research included official company websites, terms and conditions, platform documentation, and feedback from active traders across various online communities.

Key Criteria We Considered

✅ Profit Split

We assessed how much of the trading profits are returned to the trader. While most firms offer between 70% and 90%, we prioritized those with competitive payout structures and straightforward, transparent conditions.

✅ Evaluation Process

The evaluation challenge is often the gateway to receiving funding. We reviewed the complexity of each firm’s evaluation — including the number of steps, time constraints, and how achievable the profit and risk targets are.

✅ Risk Management Rules

We compared firms based on their drawdown and daily loss limits, focusing on those that strike a balance between protecting capital and allowing traders a reasonable margin for losses.

✅ Account Sizes & Scaling Opportunities

We favored firms that offer flexible account sizes and clearly defined scaling plans. This is especially valuable for traders looking to grow their accounts based on performance.

✅ Asset Classes Supported

Firms were evaluated on the variety of markets they allow access to — including forex, futures, indices, cryptocurrencies, and more — to accommodate different trading styles and experience levels.

✅ Payout Structure

We examined how frequently firms pay traders (weekly, bi-weekly, or monthly) and what payment methods they support (e.g., bank transfer, PayPal, cryptocurrency). Reliable and timely payouts are crucial to a positive trading experience.

✅ Evaluation Fees & Refund Policies

Most firms charge a fee to participate in an evaluation. We compared pricing and highlighted firms that offer refunds upon passing, discounts, or free retakes for unsuccessful attempts.

✅ Customer Support & Trader Resources

Strong customer support and access to learning resources can significantly enhance a trader’s experience. We took note of firms that offer live chat, knowledge bases, webinars, mentorship programs, or active community forums.

✅ Reputation & Transparency

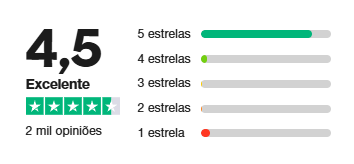

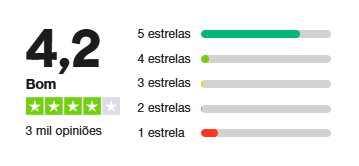

Finally, we considered each firm’s overall credibility. This included real user reviews, clarity of terms and conditions, and how openly each firm communicates its policies and expectations.