In the fast-paced world of prop firms , FTMO has long been a dominant player. Founded in 2014 and based in Prague, Czech Republic, FTMO offers funded trading accounts to retail traders who pass its two-phase evaluation process. As we step into 2025, the landscape of prop trading has evolved dramatically, with multiple firms vying for the top spot. In this article, we’ll provide a detailed FTMO review for 2025 and compare it with some of the best prop trading firms in the market today.

FTMO Overview

Key Features:

-

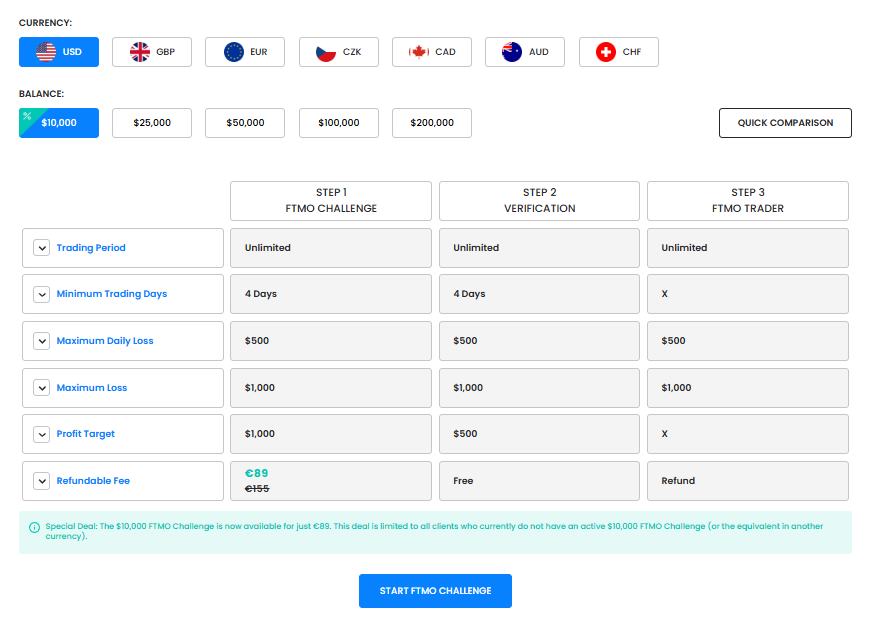

Model: Two-phase evaluation (Challenge + Verification)

-

Account Sizes: $10,000 to $200,000 (scalable up to $2 million)

-

Profit Split: Up to 90%

-

Evaluation Fee: Refundable after successful completion

-

Max Daily Drawdown: 5%

-

Max Overall Drawdown: 10%

-

Leverage: Up to 1:100

-

Instruments: Forex, indices, commodities, crypto, stocks (via CFDs)

What’s New in 2025?

-

AI Risk Management Tools: Integrated analytics for better risk profiling.

-

New Trading Platform Options: Support for cTrader and TradingView in addition to MT4/MT5.

-

Weekend Crypto Trading: Enabled for selected accounts.

-

FTMO Account Dashboard V2: Streamlined UI/UX, real-time trade analysis, psychological feedback.

✅ Pros:

-

Industry-leading reputation and reliability.

-

Generous profit split and scaling plan.

-

Professional trader development support.

-

Backed by regulated broker partnerships.

❌ Cons:

-

Strict evaluation criteria.

-

No instant funding model.

-

Slightly higher fees compared to newer prop firms.

FTMO vs. Other Top Prop Firms in 2025

Here’s how FTMO compares to other leading prop trading firms in 2025:

| Feature | FTMO | MyFundedFX | The5ers | Maverick Trading | E8 Funding |

|---|---|---|---|---|---|

| Model | 2-phase eval | 1 or 2-phase | Instant/Low-risk | Career-based | 2-phase |

| Profit Split | Up to 90% | Up to 85% | Up to 90% | 70–80% + salary | Up to 80% |

| Max Leverage | 1:100 | 1:200 | 1:10 | 1:10 | 1:100 |

| Drawdown Limits | 5% daily / 10% total | 5%/10% | 4% total (low risk) | Variable | 5%/8% |

| Refundable Fee | Yes | Yes | Yes | No (training fee) | Yes |

| Crypto Trading | Yes | Yes | Limited | No | Yes |

| Scaling Plan | Up to $2M | Up to $1.5M | Yes | Yes (slow) | Yes |

| Payout Frequency | Monthly (can be biweekly) | Biweekly | Monthly | Monthly | Weekly |

Detailed Breakdown:

1. MyFundedFX

Offers more flexible rules, higher leverage (1:200), and quicker evaluations.

Slightly lower payout percentages than FTMO.

Attracts aggressive scalpers and crypto traders.

2. The5ers

Known for instant funding and low-risk model.

Appeals to conservative traders or swing traders.

Limited leverage can be a downside for intraday traders.

3. Maverick Trading

Focuses on career traders and equity options.

Offers salary-based programs with structured training.

Long commitment and upfront training costs.

4. E8 Funding

Sleek platform, simple rules, and weekly payouts.

Rapidly growing popularity with day traders.

Profit split and scaling plan slightly behind FTMO.

Who Should Choose FTMO in 2025?

FTMO remains an excellent choice for:

Traders seeking long-term growth and scaling opportunities.

Professionals who prefer structure, discipline, and analytics support.

Those looking for strong community, tools, and reliability.

Best For:

Forex and index traders

Intermediate to advanced traders

Traders with a strong risk management mindset

Verdict: Is FTMO Worth It in 2025?

Yes. FTMO remains a top-tier prop firm in 2025. Its robust infrastructure, professional approach, and continual platform improvements keep it ahead of most of the competition. While newer firms may offer faster funding or more relaxed rules, FTMO delivers long-term trading success and has a proven track record of consistency and trust.

Final Tips Before Choosing a Prop Firm

Assess Your Trading Style – Are you a scalper, swing trader, or algo trader?

Understand Risk Limits – Know your comfort zone with drawdown and leverage.

Consider Your Goals – Do you want fast funding or long-term growth?

Always Read the Fine Print – Payout structure, scaling plans, and rules matter.

FAQs

What is FTMO and how does it work in 2025?

FTMO is a prop trading firm that funds successful traders after they pass a two-step evaluation process. In 2025, FTMO offers enhanced tools, higher profit splits, and supports platforms like MT4, MT5, and TradingView. Traders who meet the risk and profit targets receive a funded account and keep up to 90% of the profits.

Is FTMO legit in 2025?

Yes, FTMO is 100% legitimate. It has a strong global reputation, thousands of positive reviews, and has paid out millions to traders. In 2025, it continues to lead the industry with advanced technology, transparency, and consistent payouts.

Does FTMO allow weekend trading or crypto trading in 2025?

Yes, in 2025 FTMO allows weekend crypto trading and offers a wide range of instruments including forex, commodities, indices, and cryptocurrencies.

How long does it take to get funded by FTMO?

It typically takes 2–6 weeks to pass both phases, depending on your trading pace. Once approved, funded accounts are issued within 24–72 hours.