Passing a prop firm challenge is the first step toward becoming a funded forex trader—and turning your skills into real income. Yet, most traders fail prop firm evaluations.

Why? Not because their trading strategy is weak—but because their trading psychology, risk management plan, or discipline during the challenge phase isn’t ready.

In this guide, we’ll walk you through a step-by-step strategy to pass any prop firm challenge in 2025—whether it’s FTMO, The5ers, FundedNext, MyForexFunds, or Topstep. Whether you’re aiming to pass the funded account challenge or just want to avoid common prop firm mistakes, this blueprint will get you funded faster.

What Is a Prop Firm Challenge?

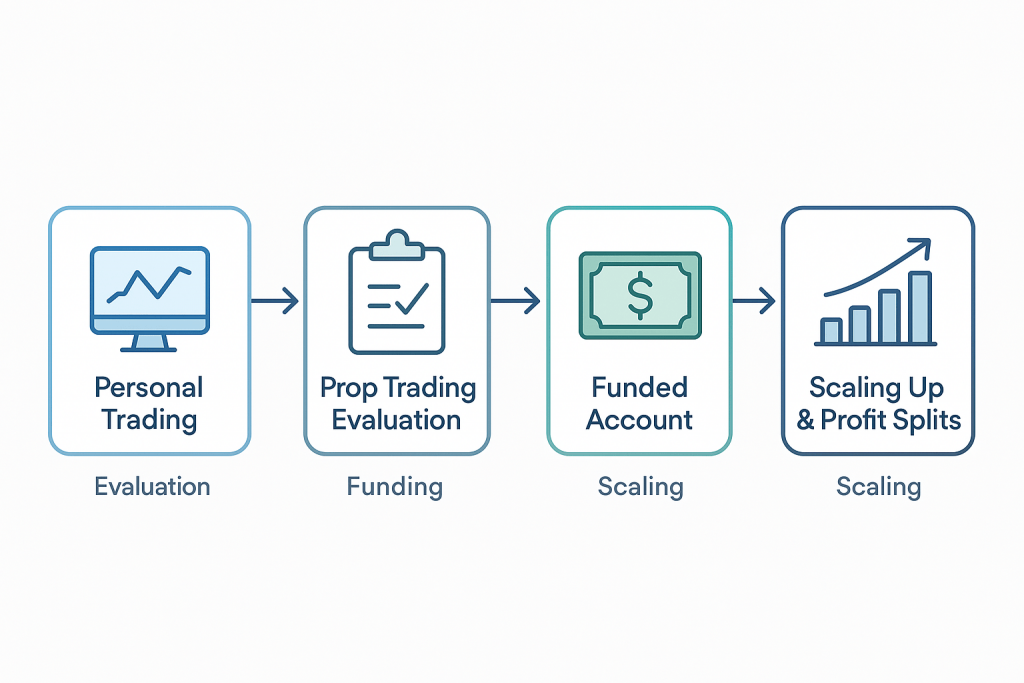

Prop firms offer traders a chance to trade with company capital. But first, you must prove yourself by completing a challenge phase (sometimes followed by a verification phase).

Key Goals You Usually Must Meet:

Hit a profit target (e.g. 8–10%)

Avoid a daily loss limit (e.g. 5%)

Stay within a maximum drawdown (e.g. 10%)

Trade for a minimum number of days (e.g. 10–15)

Use acceptable risk and strategy behavior (no gambling or exploiting loopholes)

Sounds simple? In theory, yes. In practice, it tests everything: your strategy, psychology, and consistency.

✅ Step-by-Step Strategy to Pass a Prop Firm Challenge

1. Trade Like You’re Already Funded

Mindset shift is everything.

Most traders fail because they treat the challenge like a lottery ticket—over-leveraging and swinging for big wins.

Instead:

-

Focus on preserving capital

-

Aim for consistency, not perfection

-

Ask yourself: “Would I take this trade if I were managing $100K of someone else’s money?”

2. Use a Simple, Proven Strategy

You don’t need the Holy Grail. You need:

-

Clear entries/exits

-

Defined risk per trade

-

Proven win rate (>50% is fine with good RR)

Popular prop-firm-friendly strategies in 2025 include:

-

Breakout & retest setups

-

London or NY session scalping

-

Supply & demand zones

-

Trend continuation with confirmation

Stick to 1–2 setups max. Avoid experimentation during the challenge.

3. Risk Only 0.5% to 1% Per Trade

Even if you have 10% drawdown allowed, don’t use it.

Why? Because you can’t recover easily from large losses under tight rules.

Suggested risk model:

-

0.5% risk if you’re new or first attempt

-

1% risk if you’re experienced and consistent

-

Stop trading for the day if you lose more than 2%

Remember: Survive to day 10+. That’s half the battle.

4. Trade Fewer Days, Not More

Most challenges require a minimum number of trading days—often 10.

So, you don’t need to trade every day.

-

Trade only high-quality setups

-

Sit out bad sessions or ranging markets

-

Let time work in your favor

If you hit 1–2% gains over a few clean trades, don’t rush.

5. Use a “Target Tracker”

Divide your total profit target into daily micro-goals.

Example (10% target in 20 trading days):

-

Daily goal: 0.5%

-

Weekly goal: 2.5%

-

Plan for a few losing days

Use a spreadsheet or journal to track progress and prevent overtrading.

6. Avoid News Events & Overtrading

NFP, FOMC, CPI – these spike volatility and ruin good setups. During the challenge, avoid trading major news days unless you’re highly experienced.

Also avoid:

-

Revenge trading

-

Adding to losing trades

-

Chasing moves late

Stick to your plan, not the adrenaline.

7. Use Tools Prop Traders Love

Use platforms allowed by prop firms (MT4, MT5, cTrader) and track performance with:

-

MyFXBook or FX Blue

-

Edgewonk for journaling

-

Forex Factory for news timing

Some firms now offer in-house dashboards that show drawdown, profit progress, and trade history. Use them daily.

8. 🔁 Prepare for a Retry

Even elite traders don’t pass the first time.

Good news: many prop firms offer free or discounted retries if you don’t violate rules.

Use each challenge attempt to:

-

Refine your risk model

-

Track emotional triggers

-

Sharpen trade filtering

Bonus: The “One Setup Challenge Strategy”

Here’s a minimalist approach used by many funded traders:

-

Pick one trading setup (e.g., London breakout, trend pullback)

-

Trade only that setup at the same time daily

-

Use fixed risk and reward (1:2 or 1:3)

-

Log every trade and analyze results

-

Don’t break your rules. Not even once.

Simpler = more consistent = more likely to pass.

📌 Final Thoughts: You Don’t Need to Be Perfect — Just Disciplined

Most traders who fail a prop firm challenge don’t fail because they lack skill. They fail because they:

-

Overtrade

-

Overrisk

-

Break rules when stressed

Passing is about playing defense, staying consistent, and trading like a professional, not a gambler.

If you want funding in 2025, start by proving you can manage risk. Do that, and your chances of becoming a consistently funded trader skyrocket.

FAQs

What is the best strategy to pass a prop firm challenge?

The best strategy includes strict risk management (0.5–1% per trade), one or two reliable setups, and a focus on consistency over speed. Avoid news trading and overleveraging.

How much capital do I need to start a prop firm challenge?

Most prop firms charge a one-time fee between $99–$999, depending on the account size (e.g., $10K–$200K). No large upfront capital is needed—just skill and discipline.

How long does it take to pass a prop firm challenge?

Challenges usually last 10–30 days. If you're consistent and disciplined, many traders pass within 2–3 weeks. Some firms offer “instant funding” with no challenge required.

Can beginners pass a prop firm challenge?

Yes—but only with proper preparation. Beginners should start with a demo or low-cost account, refine their strategy, and focus on risk management before taking the challenge.